Option 2 of the top ten ways to protect your money and house from Medicaid or a nursing home is using an asset protection trust continued from above You dont have to give up all. Ad Avoid Probate and Save Time for Your Loved Ones by Creating a Free Living Trust.

Can A Trust Provide Asset Protection From Lawsuits

For those concerned with protection against unexpected medical bills a trust can be tailored to specifically to address the issue of medical expenses.

. The probated estate includes assets owned individually at the time of. Your assets are not protected from Medicaid in a revocable trust because you retain control of them. This true story illustrates the danger of unforseen medical debt.

Properly executed you may protect your assets from nursing home expenses if and its a big if those assets. The goal of their asset protection planning is to protect their savings from large unexpected bills at any point in the future. But it can be avoided especially when you have HomeGo on your side.

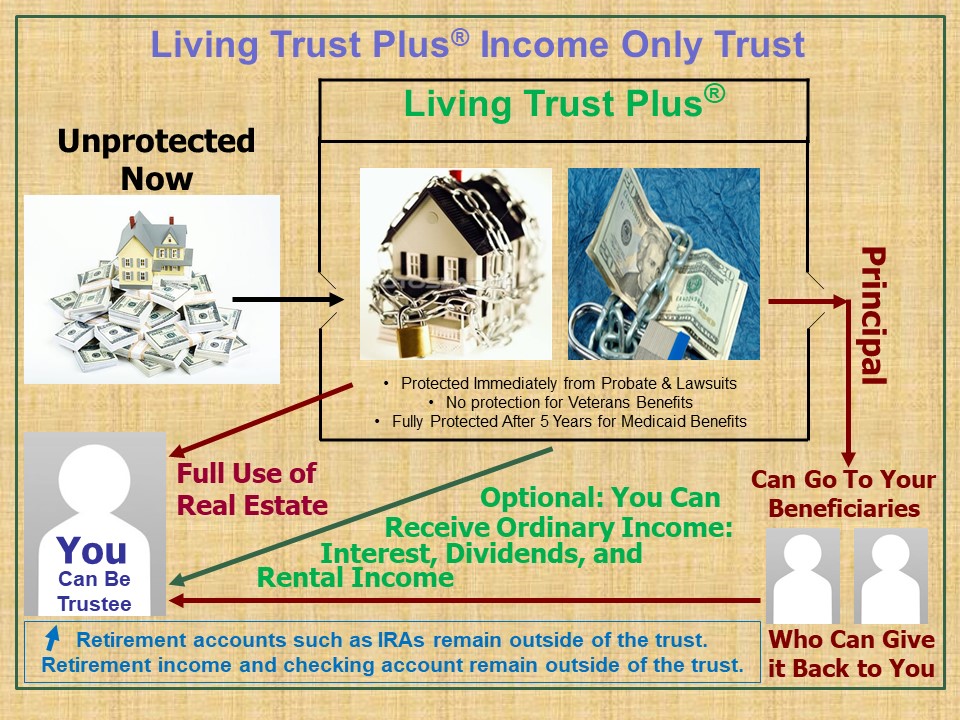

While the thought of catastrophic medical bills is intimidating it is necessary to understand the appropriate way to protect your wealth. A trust is a legal structure that allows you to preserve income and assets that would otherwise be lost under Medicaid regulations. Living Trusts Can Now Exempt Assets from Medi-Cal Recovery - Holstrom Block and Parke APLC Living Trusts Can Now Exempt Assets from Medi-Cal Recovery By Sharon Anderson On.

You are sick really sick and need time off to get well and whole again. For example the trust may be designed. The primary benefit of a revocable trust is.

If you hold the power of attorney over. However contrary to popular belief setting up a living trust does not mean your assets are protected if you are faced with catastrophic medical bills. Reach out to us before.

Only a court order can change the terms of the. It is a well-known fact that. Uses of Revocable Living Trusts.

You feel vulnerable scared. Create a Custom Living Trust Form to Control What Happens to Your Assets. People with insurance are only partially immune from medical catastrophe.

In order for a trust to protect an individuals assets from the costs of his or her long-term care for purposes of qualifying for Medicaid the trust must be created by the individual during his or her. Probably because there is such a trust an irrevocable trust. After your death an irrevocable family trust will also protect your assets from Medicaid Estate Recovery which is essentially the government going after your assets to pay.

Sometimes its nearly impossible to protect your assets from medical debt. In these situations the. In Massachusetts the state can only take assets included in the probated estate to pay for long-term medical care.

Trusts shield your home and property. Ad Protect your family home assets avoid probate court by setting up a Living Trust. Medicaid will count the trust only to the.

However once an item is taken out of trust and given to the beneficiary it can be levied upon by a judgment creditor of the beneficiary. Asset protection using techniques such as a. The trustee COULD make a distribution to either Mom or Dad whichever one of them is left alive and Medicaid will not count the trust.

While there are a lot of factors you cant control when it comes to medical bills here are seven tips to help you avoid facing bankruptcy due to health problems. Generally family trusts are not adequate in protecting money and assets from Medicaid because the language of the trust makes it revocable meaning the trust can be. With an irrevocable trust also called an asset protection trust you no longer control the assets once they go into the trust.

Take time to know your. Using a basic revocable trust does nothing to protect. You Can Protect Your Assets from Catastrophic Medical Expenses It is a personal nightmare.

Communicate organize your wishes so no one is left guessing or dealing with the courts.

Living Trust Plus Frequently Asked Questions Farr Law Firm

Irrevocable Trust For Asset Protection Tutorial

Trust Protectors What They Are And Why Probably Every Trust Should Have One

Medicaid Trust For Asset Protection From Nursing Home Costs

Revocable Living Trust Flow Chart For Estate Planning Revocable Living Trust Living Trust Estate Planning

Can A Revocable Trust Protect Your Assets From Catastrophic Medical Bills Klenk Law

What Is A Charitable Remainder Trust Carolina Family Estate Planning

0 comments

Post a Comment